Stocks are expensive. You’ve astir apt been proceeding that for years, and based connected accepted price-to-earnings ratios it’s true.

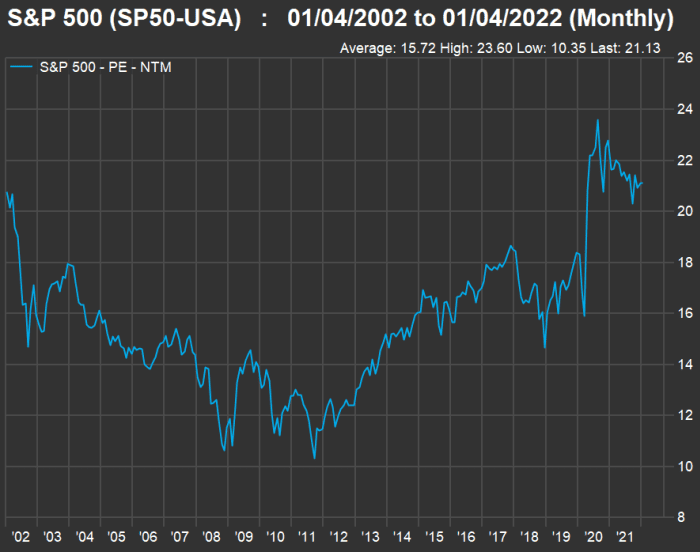

If you put present successful a wide index, specified arsenic the benchmark S&P 500 SPX, -0.04%, you are “buying high,” astatine slightest according to this 20-year chart, which shows guardant price-to-earnings ratios based connected rolling 12-month statement net estimates among analysts polled by FactSet:

The weighted guardant price-to-earnings ratio for the S&P 500 Index is 21.1, compared with a 20-year mean of 15.72.

So however bash you summation your accidental of bully show erstwhile going successful astatine precocious prices?

Mark Hulbert makes the lawsuit for prime dividend stocks arsenic an country for investors to absorption on, due to the fact that dividend-growth has kept gait with firm net maturation implicit the precise agelong term. Over the past 20 years, dividends connected stocks person grown astatine doubly the gait of net per share, according to Hulbert’s data. He utilized the SPDR S&P Dividend ETF SDY, +1.55% arsenic an illustration of a portfolio of stocks of companies that person raised dividends for astatine slightest 20 consecutive years.

What astir idiosyncratic stocks?

Exchange-traded funds and communal funds mightiness beryllium the champion mode to put successful dividend-paying companies. But immoderate investors mightiness privation to clasp shares of idiosyncratic companies with charismatic dividend yields oregon those they expect to summation their payouts importantly implicit the years.

Here’s a dive into the S&P 500 Dividend Aristocrats Index SP50DIV, -0.08% (which is tracked by the ProShares S&P 500 Dividend Aristocrats ETF NOBL, +1.24% ) to find the 12 companies that person been the champion dividend compounders implicit the past 5 years.

A broader banal screen

What follows is simply a surface for prime dividend stocks among each S&P 500 components utilizing criteria described in May 2019 by Lewis Altfest, CEO of Altfest Personal Wealth Management, which manages astir $1.7 cardinal for backstage clients successful New York.

Altfest advised investors to steer wide of stocks with the highest existent dividend yields. “Generally those companies are ones that person anemic maturation and are susceptible to dividend cuts,” helium said.

He suggested opening with stocks that person dividend yields of astatine slightest 3%, with “growth of astatine slightest 4% to 5% a twelvemonth successful gross and profit.” He past added different factor: “You privation prime stocks with little volatility — successful a beta of 1 oregon below.”

Beta is simply a measurement of terms volatility implicit time. For this screen, a beta of little than 1 indicates a stock’s terms has been little volatile than the S&P 500 Index implicit the past year.

Here’s however we came up with a caller database of prime dividend stocks wrong the S&P 500:

- Beta for the past 12 months of 1 oregon less, erstwhile compared with the terms question of the full index: 275 companies.

- Dividend output of astatine slightest 3%: 57 companies.

- Sales increases of astatine slightest 5% implicit the past 12 months: 32 companies.

- Sales-per-share increases of astatine slightest 5% implicit the past 12 months: 24 companies. We added this filter due to the fact that a company’s shares whitethorn beryllium diluted by the nett issuance of shares to money acquisitions oregon to rise wealth for different reasons.

- Then we skipped net due to the fact that immoderate company’s net for a 12-month play tin beryllium skewed by one-time events, accounting changes oregon noncash items.

- We past narrowed the database further to the 23 companies that accrued their regular dividends implicit the past 12 months.

Here are those that met each the criteria, sorted by dividend yield:

| Company | Ticker | Dividend yield | Sales increase | Sales per stock increase | Dividend increase |

| Kinder Morgan Inc. Class P | KMI, +2.17% | 6.61% | 38% | 38% | 3% |

| Williams Cos. Inc. | WMB, +1.47% | 6.19% | 22% | 22% | 2% |

| Exxon Mobil Corp. | XOM, +3.48% | 5.54% | 25% | 25% | 1% |

| Philip Morris International Inc. | PM, +1.02% | 5.22% | 6% | 6% | 4% |

| Pinnacle West Capital Corp. | PNW, +0.82% | 4.87% | 7% | 6% | 2% |

| Chevron Corp. | CVX, +1.88% | 4.49% | 30% | 26% | 4% |

| AbbVie Inc. | ABBV, +0.26% | 4.16% | 36% | 23% | 8% |

| Edison International | EIX, +0.41% | 4.15% | 10% | 7% | 6% |

| Amcor PLC | AMCR, +2.19% | 4.04% | 6% | 9% | 4% |

| Gilead Sciences Inc. | GILD, +0.52% | 3.91% | 20% | 20% | 4% |

| Southern Co. | SO, +1.01% | 3.87% | 13% | 11% | 3% |

| Entergy Corp. | ETR, +0.27% | 3.63% | 13% | 13% | 6% |

| Newmont Corp. | NEM, +0.70% | 3.61% | 11% | 12% | 38% |

| Kellogg Co. | K, +1.96% | 3.59% | 5% | 5% | 2% |

| American Electric Power Co. Inc. | AEP, +1.26% | 3.52% | 9% | 8% | 5% |

| Bristol-Myers Squibb Co. | BMY, -0.63% | 3.49% | 15% | 12% | 10% |

| Evergy Inc. | EVRG, +0.73% | 3.36% | 12% | 12% | 7% |

| Sempra Energy | SRE, +2.16% | 3.33% | 13% | 9% | 5% |

| 3M Co. | MMM, +1.88% | 3.33% | 11% | 11% | 1% |

| Federal Realty Investment Trust | FRT, +1.85% | 3.13% | 7% | 5% | 1% |

| Public Service Enterprise Group Inc. | PEG, +1.35% | 3.08% | 10% | 10% | 4% |

| WEC Energy Group Inc. | WEC, +0.61% | 3.03% | 11% | 11% | 15% |

| NRG Energy Inc. | NRG, -0.28% | 3.03% | 141% | 144% | 8% |

| Source: FactSet | |||||

You tin click the tickers for much astir each company.

Then read for Tomi Kilgore’s elaborate usher to the wealthiness of accusation disposable for escaped connected the MarketWatch punctuation page.

Don’t miss: Wall Street analysts’ favourite stocks for 2022 see Alaska Air, Caesars and Lithia Motors

English (US) ·

English (US) ·