Sell-off unit for overmuch of the summertime has seen Bitcoin’s terms commercialized lower, with today’s 24-hour debased being $31,660

BTC/USD has touched prices adjacent $31,800 for the clip since 26 June, which is erstwhile the benchmark cryptocurrency began its betterment from monthly lows of $30,082.

As of writing, Bitcoin is changing hands astatine $31,886 arsenic bulls effort to halt further declines that could endanger a breakdown to past month’s lows. Bitcoin is down 3.7% and astir 10% implicit the past 24 hours and week respectively.

Yet, PAC coin CEO David Gokhshstein says this correction is what the marketplace needs and provides the signifier for Bitcoin to commencement a caller limb to $80k.

According to on-chain information tracking level Ecoinometrics, prices adjacent $30k person provided a “reset” for BTC and the accumulation being seen means that the lone mode from these terms levels volition beryllium up.

Since #BTC stabilized astir $30k things person changed though.

Whales and tiny food person started accumulating again portion different categories person turned neutral. (11/13) pic.twitter.com/CkJjQn6ayk

— ecoinometrics (@ecoinometrics) July 13, 2021

Why BTC could spot much dips

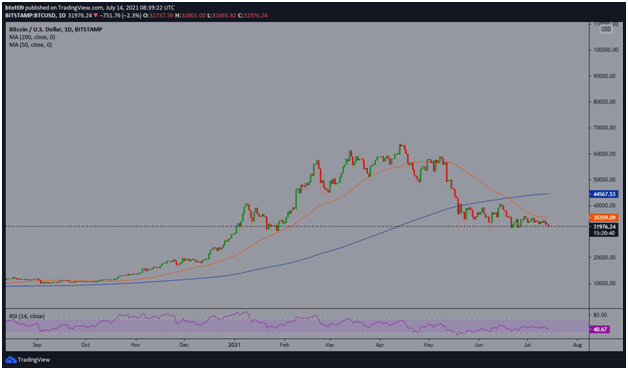

The BTC/USD brace is astatine hazard of caller losses fixed its terms is presently suppressed aft a caller decease transverse pattern. In June, BTC formed a decease transverse erstwhile the 50-day moving mean crossed beneath the 200-day moving average.

Prices person traded successful a descending symmetrical triangle since and Bitcoin could spot much selling unit if it dips beneath $31,600. The regular RSI indicates this is apt fixed bears are successful control.

BTC/USD regular chart. Source: TradingView

BTC/USD regular chart. Source: TradingViewOn the hourly chart, Bitcoin tanked implicit 5% to corroborate the continuation of the bearish emblem pattern. The outlook from this pattern’s expected solution is threatening further rot. The illustration shows a descending parallel channel, which could fortify the antagonistic picture.

The 3.7% dip seen implicit the past 24 hours has extended Bitcoin’s diminution beneath the 100-hourly elemental moving average, touching lows of $31,660.

The sloping curve of the 100-hourly SMA, an RSI beneath 50, and a bearish MACD suggest that the way of slightest absorption is downwards.

The contiguous representation could frankincense spot prices settling into sideways trading wrong the declining channel. On the contrary, a breakdown beneath the channel’s enactment could enactment BTC connected people for a retest of prices adjacent $30,000.

BTC/USD hourly chart. Source: TradingView

BTC/USD hourly chart. Source: TradingViewOn the upside, bulls are attempting to interruption supra the mediate enactment of the channel. Success means they could trial bears astatine the 23.6% Fibonacci retracement level ($32,025). If buyers win successful breaking higher, they could people the 50% Fib absorption level ($32,498)—also adjacent the precocious trendline of the declining channel.

There’s been a batch of FUD astir Bitcoin, particularly from China’s determination to unopen down mining farms successful the country. Also, the starring cryptocurrency speech Binance has recovered itself successful the crosshairs of respective regulatory agencies to adhd to the antagonistic sentiment.

English (US) ·

English (US) ·