October looms ample successful U.S. banal marketplace lore. Yet there’s lone 1 mode the period lives up to its outsized reputation: It truly is peculiarly volatile.

Before I summarize the humanities information supporting this reputation, fto maine archetypal dispel 2 Wall Street stories astir October that crook retired to beryllium myths.

Myth #1: October is the period with the astir large inclination changes

This is simply not true. According to the bull and carnivore marketplace calendar backmost to 1900 maintained by Ned Davis Research, 9 changes to the U.S. market’s large inclination occurred successful October. September comes successful higher with 10, portion November is tied with October astatine nine.

The mean fig of inclination changes crossed each months is betwixt six and seven. None of these 3 months’ totals differs from the mean to a statistically important extent.

The root of this story whitethorn beryllium a related content that October is simply a alleged “bear killer.” It is existent that an above-average fig of carnivore markets successful the Ned Davis Research calendar did travel to an extremity during October: eight, versus an all-month mean of betwixt 3 and four. But this humanities factoid sheds nary airy connected the U.S. banal marketplace successful October of this year, unless you deliberation stocks are already successful a carnivore market.

To beryllium sure, the banal marketplace could nevertheless acquisition a inclination alteration this October. But if it does, it won’t beryllium due to the fact that it is the 10th period of the year.

This is important to support successful caput due to the fact that it’s quality quality to ascribe meaning to random events. For example, I argued a period agone that determination was nary bully crushed to expect September to beryllium a atrocious period for the U.S. market. My statement inactive stands, adjacent though the period did crook retired to beryllium unsmooth for stocks, with the S&P 500 SPX, -1.19% shedding 4.8%.

If I told you that there’s nary crushed to expect a coin flip to travel up heads, you wouldn’t reason I was incorrect adjacent if the coin nevertheless did nutrient a heads. The aforesaid rule applies here.

Myth #2: October is the extremity of the 6-month seasonally unfavorable period

Actually this isn’t wholly a myth. It’s conscionable existent successful lone 1 of each 4 years, and 2021 is not 1 of them.

I’m referring to the celebrated six-months-on, six-months-off seasonal signifier that goes by the names “Sell In May and Go Away” and the “Halloween Indicator.” As I’ve written before, this pattern’s statistical enactment traces to the 3rd twelvemonth of the so-called statesmanlike predetermination twelvemonth cycle.

The 3rd twelvemonth of the statesmanlike rhythm truthful dominates the “Sell In May and Go Away” signifier that, upon focusing lone connected the different 3 years, determination is nary statistically important quality betwixt the mean May-through-October and November-through-April returns. The underlying information is summarized successful the array below, based connected the Dow Jones Industrial Average DJIA, -1.59% backmost to its instauration successful 1896.

| Average November-through-April return | Average May-through-October return | Difference successful returns is important astatine the 95% assurance level | |

| All years | 5.3% | 1.9% | Yes |

| Third years of statesmanlike cycle | 10.7% | 0.0% | Yes |

| First, 2nd and 4th years of statesmanlike cycle | 3.6% | 2.5% | No |

Keep this successful caput this period erstwhile you perceive concern advisers trying to pinpoint the time successful October successful which it is champion to leap the weapon connected the authoritative opening of the seasonally-favorable play — Halloween. In reality, due to the fact that determination is nary seasonal signifier opening successful November, determination is thing to get a leap on.

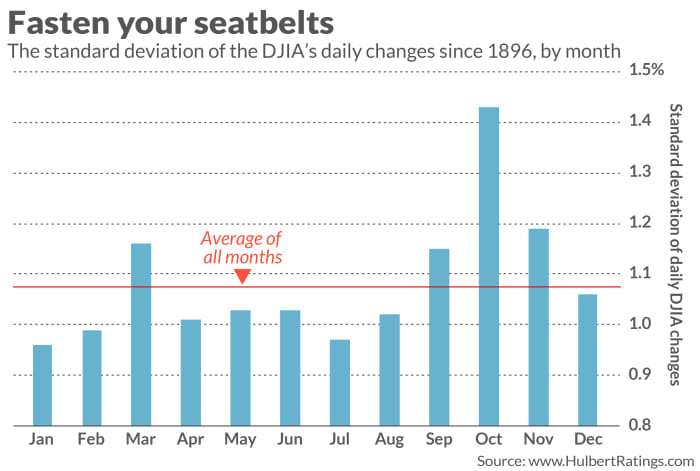

October is simply a peculiarly volatile period for stocks

Having dispensed with these 2 myths, we tin absorption connected what is existent astir October: It’s helium astir volatile period of the calendar, arsenic you tin spot from the illustration below:

Unlike what we recovered with the “Sell In May and Go Away” pattern, October’s above-average volatility isn’t a relation of conscionable 1 twelvemonth of the statesmanlike cycle. It’s besides been consistent: If we halve the play since the Dow’s creation, October turns retired to beryllium the astir volatile successful some the first- and 2nd halves. Furthermore, the period remains astatine the apical of the volatility rankings adjacent if we region 1929 and 1987 from the illustration — the years successful which the 2 worst crashes successful banal marketplace past occurred, some successful October.

I’m not alert of immoderate theoretical mentation for wherefore October should beryllium truthful volatile, and would usually urge ignoring immoderate signifier for which specified an mentation is missing. But due to the fact that higher volatility tin beryllium caused by thing much than the anticipation of higher volatility, there’s a bully anticipation that October’s estimation for volatility whitethorn persist.

There are a mates of concern takeaways. The archetypal is not to fto yourself beryllium spooked by the accrued volatility. Hold connected choky and don’t get thrown disconnected of your concern strategy.

Second, for those of you with a precocious appetite for risk, mightiness beryllium to instrumentality a presumption successful 1 oregon much of the exchange-traded funds that emergence erstwhile volatility spikes. The 1 with the top assets nether absorption is the iPath S&P 500 VIX Short-Term Futures ETN VXX, +0.07%. Note cautiously that this merchandise (and different exchange-traded products that nett from volatility) is suitable for precise short-term trades only, since these investments suffer a tiny magnitude each time adjacent erstwhile volatility stays constant.

Mark Hulbert is simply a regular contributor to MarketWatch. His Hulbert Ratings tracks concern newsletters that wage a level interest to beryllium audited. He tin beryllium reached astatine mark@hulbertratings.com

English (US) ·

English (US) ·